Company Nurse, your premier workplace injury reporting and nurse triage service.

Powered by Lintelio, the industry's best intake and communication technology platform.

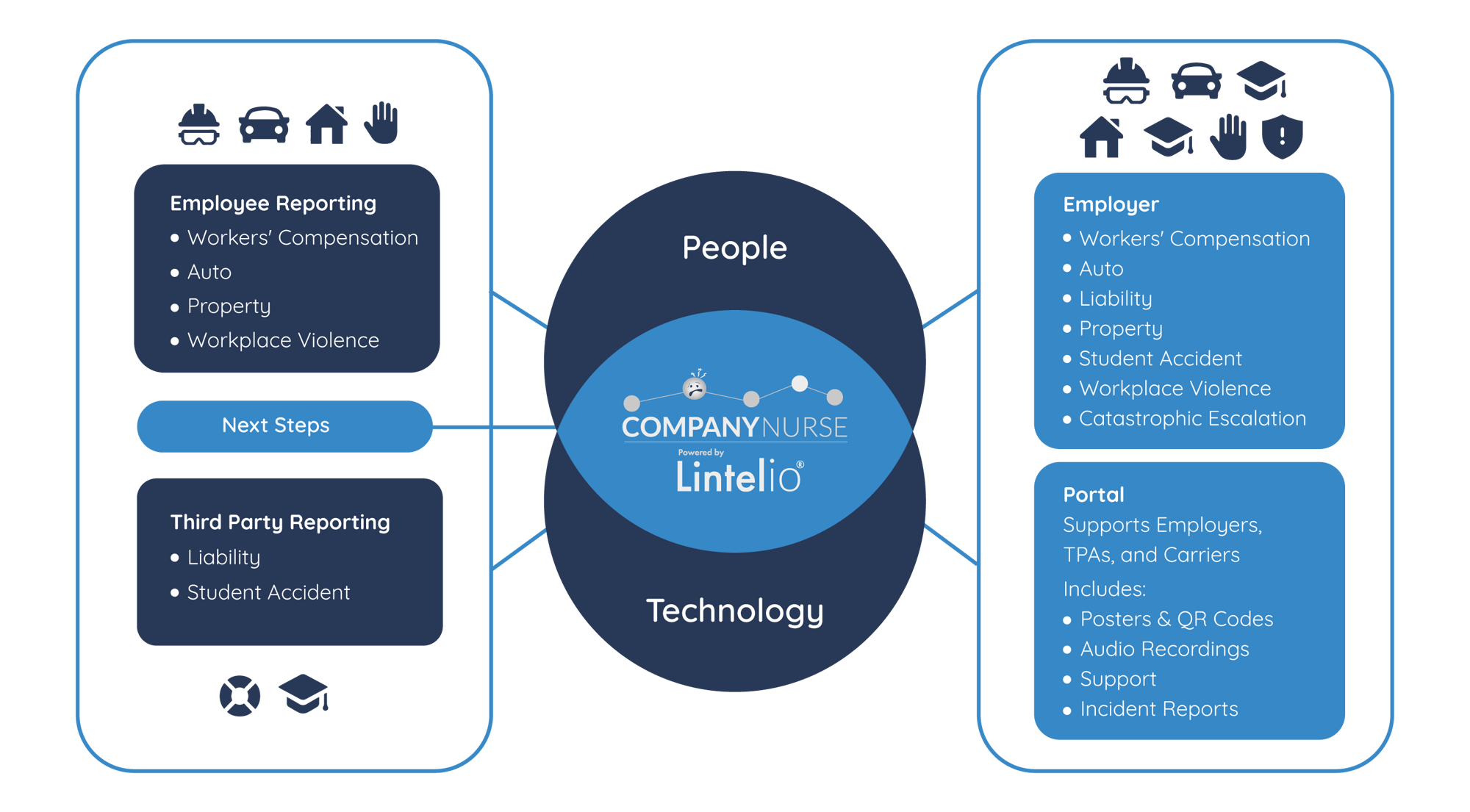

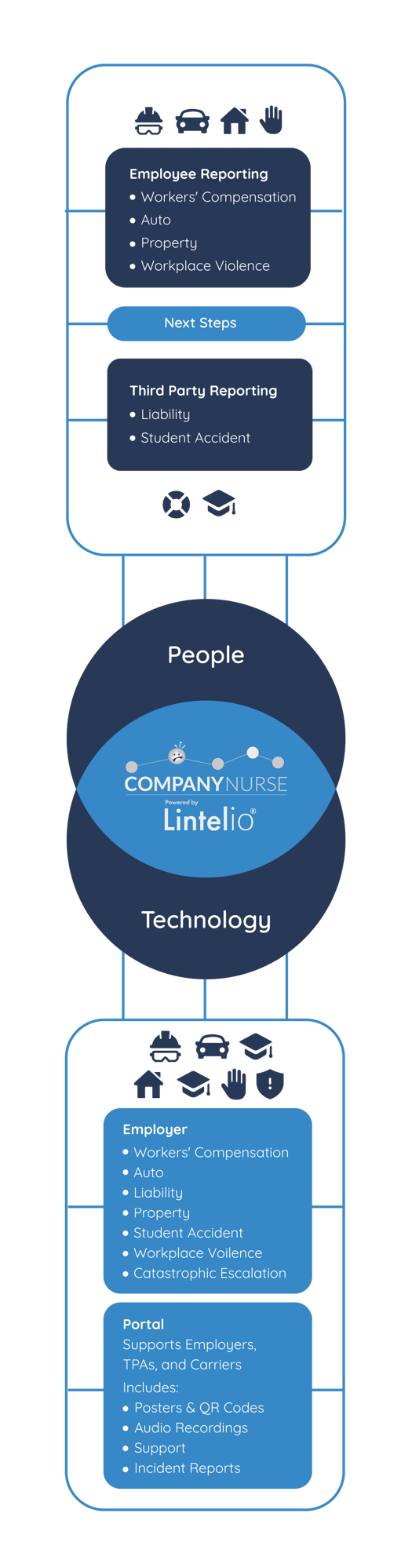

We’ve created the first unified approach of its kind in the workplace incident and nurse triage arena.

We aren’t just transforming

the incident reporting process.

We’re perfecting it.

Company Nurse powered by Lintelio is bridging the gaps between advanced security, human compassion, and cutting-edge technology to drive outstanding outcomes for all parties involved in your claims management process.

Our formula for Experience Excellence

Compassionate Care + Digital Empathy + Swift Delivery

Our Unified Approach

You deserve a simple, secure, and reliable intake, triage, and reporting platform that offers unique customizations, eliminates administrative burdens, and speeds the flow of information.

Best-in-industry technology + the best of the right human touch + advanced security

Here's what sets Company Nurse powered by Lintelio apart:

Pillars of Success

Collaboration

We are your partner.

We are your partner.

- Configurability

- Responsiveness

- 100% Focus

Future-Proof Technology

Solutions designed for adaptability.

Solutions designed for adaptability.

- Security

- Agility

- Omni-Channel

- Automation

Reputation

Renowned market leader investing in people and technology.

Renowned market leader investing in people and technology.

- Reliability

- Accountability

- Trustworthiness

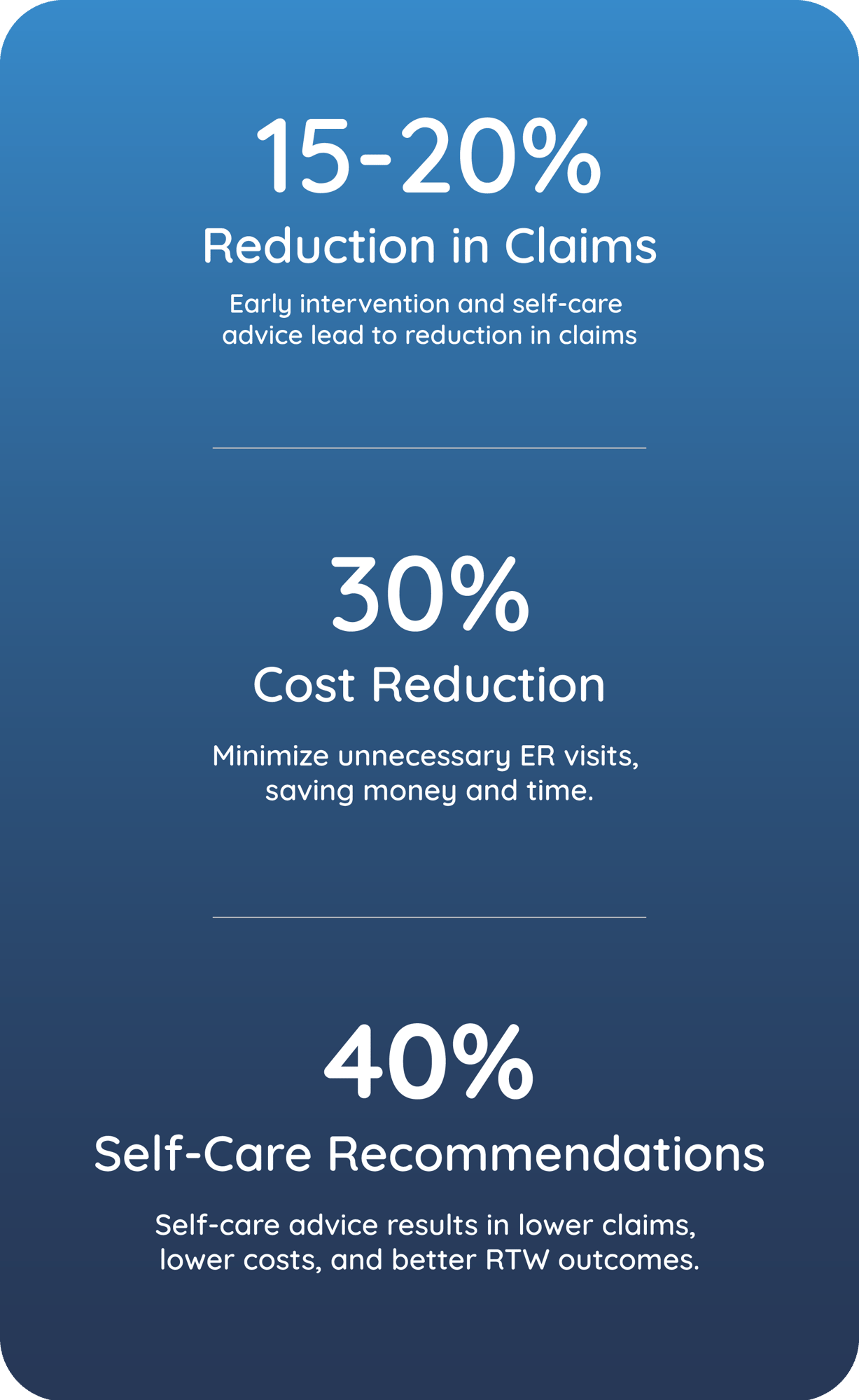

Outcomes We Are Proud Of

.png?width=2000&height=598&name=Results%20Graphic%20-%20New%20Website_1%20(1).png)